how to declare mileage on taxes

Of course the IRS isnt going to take your word for it. Use the IRSs standard deduction for mileage The easiest way to take advantage of the mileage deduction is to apply the IRSs standard mileage rate to your.

Transport And Travel Costs Of Your Employees In The Netherlands Tax Rules

If you go to the grocery store to buy a cake for your assistants birthday is that technically a business expense.

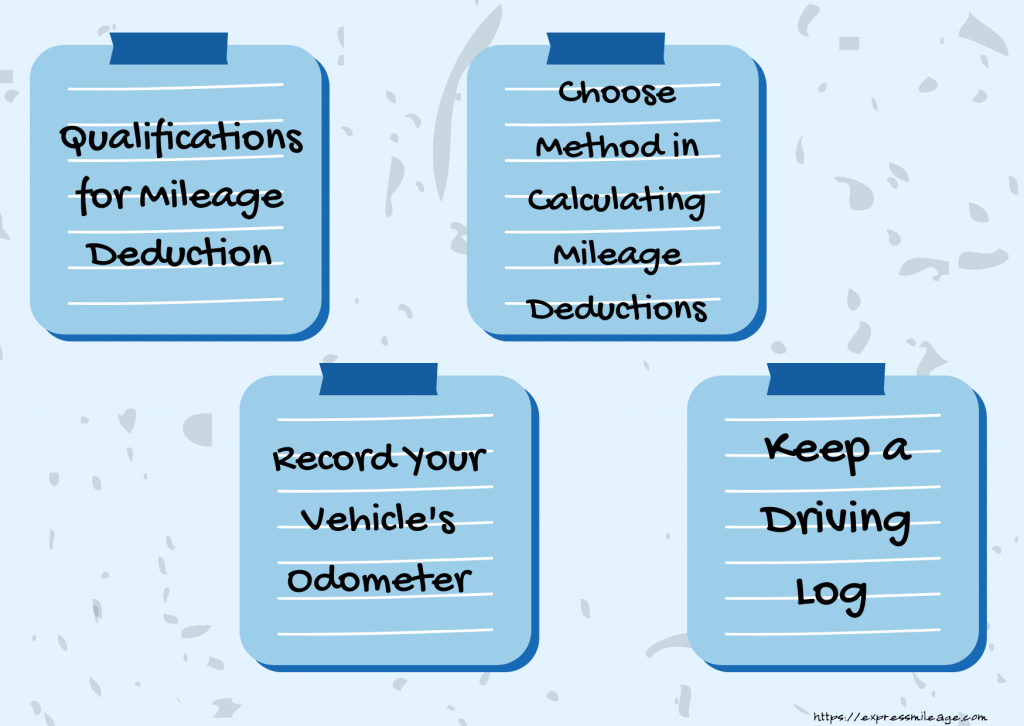

. Rates per business mile. You must file a tax return if you have net earnings from self-employment of 400 or more from gig work even if its a side job part-time or temporary. To use the standard mileage rate you must own or lease the car and.

Simply multiply the business miles by the mileage rate. Rates in cents per mile. Business transportation would be.

Gas repairs oil insurance registration and of course. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. The IRS sets a standard mileage reimbursement rate.

Now to calculate the mileage deduction. How To Declare Taxes As An Independent Consultant Sapling Business Mileage Lularoe Business Business Tax. The most important tax deduction for rideshare drivers is the mileage deduction since it will be your biggest driving expense.

Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. To use this method. Ad Browse discover thousands of unique brands.

The mileage tax deduction is calculated by multiplying qualified mileage by the annual rate set by the Internal Revenue Service. 100 056 56 tax deduction in 2021 What Qualifies as a Tax-Deductible Business Trip. Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need.

Read customer reviews best sellers. In the past mileage logs were often paper. Compare Tax Preparation Prices and Choose the Best Local Tax Accountants For Your Job.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. There are two ways to claim the mileage tax deduction when driving for Uber Lyft or a food delivery service. If you used your.

You must pay tax on. Multiply your business miles driven by the standard rate 56 cents in 2021. Deduct your mileage expense to lower your taxable income.

You must not operate five or more cars at the same time as in a fleet operation. For 2017 you can claim. Standard Mileage Rate - For the current standard mileage rate refer to Publication 463 Travel Entertainment Gift and Car Expenses or search standard mileage rates on IRSgov.

The best way to Create a Mileage Expense Sheet in Excel Begin Excel and choose the File tab. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes. If you travel away from home for business reasons you can deduct mileage related to those trips as an unreimbursed employee business expense on Schedule A Form 1040.

Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p. Deduct your mileage expense to lower your taxable income.

Self Employed Mileage Deduction Guide Triplog

Learn To Log Business Mileage For Taxes Expressmileage

.png)

Mileage Vs Actual Expenses Which Method Is Best For Me

Your 2020 Guide To Tax Deductions The Motley Fool

10 Key Tax Deductions For The Self Employed

Bill Of Sale For Motorcycle Check More At Https Nationalgriefawarenessday Com 15593 Bill Of Sale For Motorcycle Bill Of Sale Template Lettering Templates

:max_bytes(150000):strip_icc()/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

Standard Mileage Rate Definition

What Are The Mileage Deduction Rules H R Block

12 Form Mailing Address How To Have A Fantastic 12 Form Mailing Address With Minimal Spendin Calendar Template Printable Calendar Template Irs Forms

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

What Business Mileage Is Tax Deductible

Tracking Your Taxes For Direct Sales Consultants Direct Sales Consultant Direct Sales Thirty One Business

How To Declare Taxes As An Independent Consultant Sapling Independent Consultant How To Plan Thirty One Business

Mileage Log Template Free Excel Pdf Versions Irs Compliant

![]()

Free Business Income And Expense Tracker Worksheet Business Expense Tracker Expenses Printable Expense Tracker

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Tax Free Commuter Allowances End December 31st In The Mobilexpense